David Jones

Phoenix Communications

The Advantages of Cloud Based Telecoms

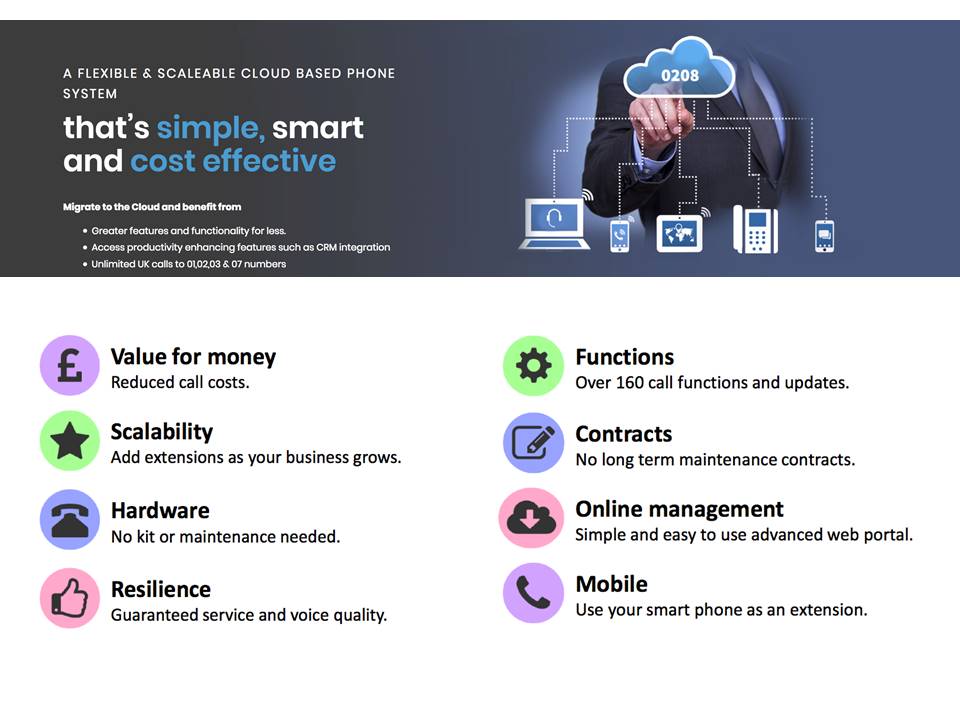

1. Predictable monthly costs

This may seem like old news, but many companies don’t realize just how much they can save by moving their communications to the cloud.

By utilising a hosting phone system over the Internet, businesses are charged on an “as needed” basis, paying only for what they use. That makes the cloud especially cost-effective for small businesses—eliminating the need to pay for the installation and maintenance of a traditional PBX phone systems and lines

2. Scalability

Scale up or down based on users. Anyone who has moved or expanded an on-premise phone system knows just how difficult it can be. Whether a business is growing, moving or sizing down, the cloud provides the flexibility and scalability the business needs now and in the future. And with cloud-based systems, businesses can access and add new features without any new hardware requirements.

3. Number Retention

Traditionally if a business moved area outside their current exchange they would either have to get a new number or they had to pay to keep the number and forward it to their new number. By porting the number to the cloud you remove all of this hassle and expenditure.

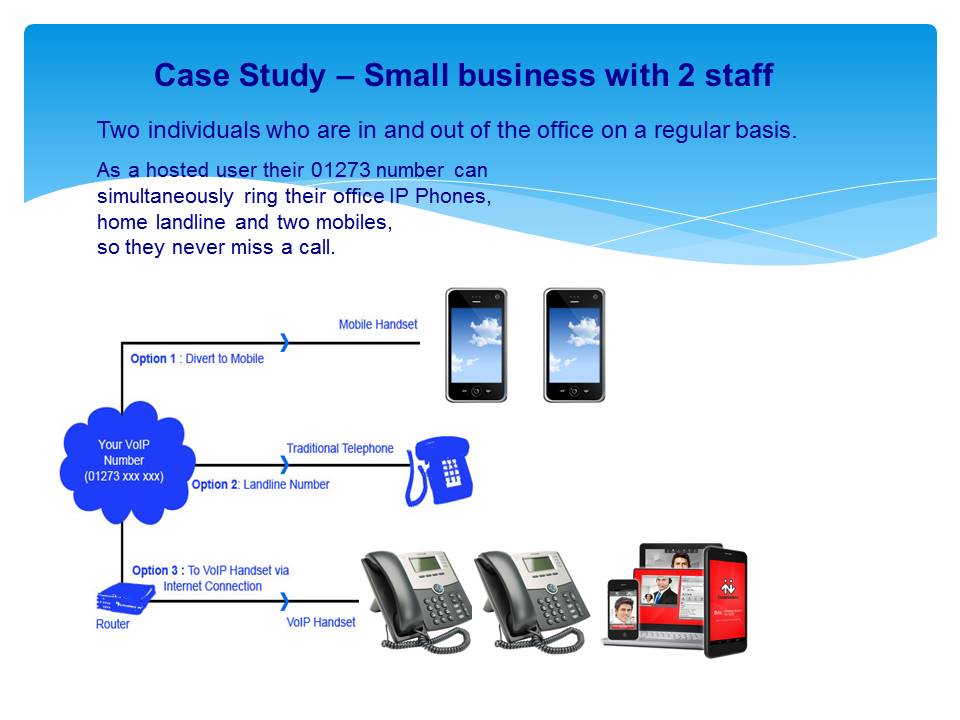

4. Mobile Integration

Work is no longer a place we go. Work is something we do, whether it is at home or the local coffee shop. Cloud Telecoms allows employees to work anywhere, anytime, and on any device they choose.

With cloud-based communications, remote workers have access to the full feature set from their mobile devices anywhere they go, just as if they were sitting at their desks. It opens up a whole new world of productivity and possibilities.

5. Technology

Instant updates. With cloud based communications, the service is outsourced, and upgrades are deployed through automatic software updates. This allows organizations to stay focused on their business and leave the upgrades to the cloud telecoms provider

6. Disaster recovery – Business continuity made easy

Businesses are using the cloud to protect themselves from the affects of disasters . With cloud communications, they can get up and running quickly after a disaster, or in some cases, continue running the entire time.

If connectivity at site fails calls can automatically reroute to remote locations and mobile phones.

7. Quality of service

Maximize uptime and downtime coverage. For many businesses, uptime is pivotal. To keep things running, they rely on the ability to scale and leverage remote work teams or serve customers from anywhere. For these kinds of businesses, cloud communications maximizes uptime and coverage through the service providers multiple, remotely hosted data centers, helping them avoid costly interruptions and downtime.

Case Study